Commit to low-carbon transformations to

become a green practitioner and realize environmental sustainability

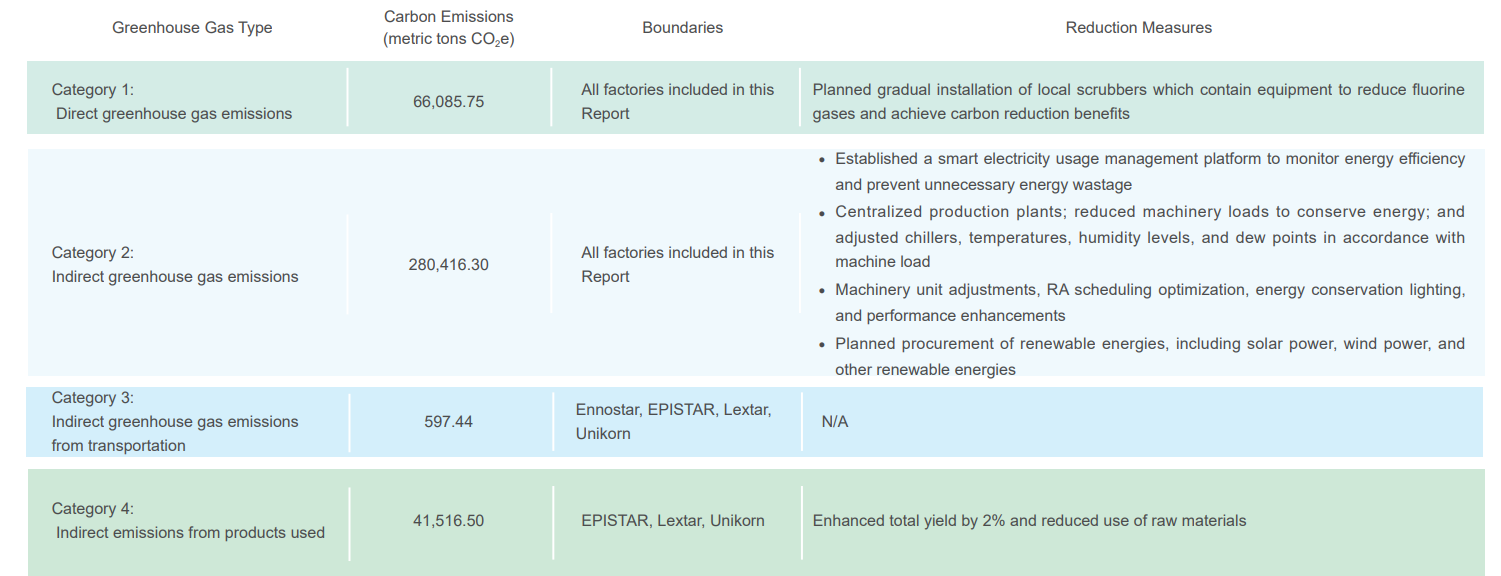

The Group’s greenhouse gas emissions include direct emissions, indirect emissions associated with energy usage, and other indirect emissions. Sources of direct emissions include gases used during production processes (PFCs, N2O, CH4, CO2); equipment for preventing volatile organic compound pollution; emergency generators; natural gas, liquefied petroleum gas, petroleum, diesel, and other fuels used by other facilities; and fugitive emissions from septic tanks, fire drills, and associated equipment. Indirect emissions associated with energy usage mainly stem from purchased electricity. Other emissions stem from product and material transportation, supplier production, employee travel, waste treatment, and employee commutes.

The Group’s total greenhouse gas emissions for 2023 amounted to 646,989.20 tCO2e. Total Category 1 and Category 2 emissions amounted to 284,454.56 tCO2e. Category 1 direct emissions amounted to 37,478.27 tCO2e, 5.79% of total Group emissions; Category 2 indirect emissions from energy used mainly stemmed from externally purchased electricity and amounted to 246,976.29 tCO2e, 38.17% of total Group emissions. Total Category 3 and Category 4 indirect greenhouse gas emissions amounted to 362,534.64 tCO2e, 56.03% of total Group emissions. The scope of Category 4 emissions from purchased goods was expanded from the top 10 suppliers to the top 70% of suppliers (total procurement amounts ranked in the top 70% in 2023), and therefore carbon emissions increased. We gained a comprehensive understanding of Ennostar emissions in all categories through ISO 14064-1 inventories, and set reduction targets accordingly.

At year-end 2023, the Group linked variable remuneration for senior executives with environmental indicators including overall carbon emission reduction and overall electricity savings.

Starting from 2024, The Long-term Incentive Plan (LTI) will be implemented in the form of a three-year contract combined with a shareholding trust to agree on the operational performance indicators of the Company and peers of each year, as well as ESG performance indicators covering the environment, society, and corporate governance and individual performance indicators, and contribute an agreed fund to subscribe for the Company’s shares and put them under trust. On the expiration date, the incentive shares will be settled based on the achievement of each indicator when the relevant conditions are fulfilled. The ESG performance indicators include two environmental indicators : 1. Overall reduction of carbon emmission 2. Overall energy-saving

11 % of total C-suite and board-level monetary incentives linked to the management of this environmental issue.

Note: All Group figures were calculated using the GWP value in the United Nations Intergovernmental Panel on Climate Change Sixth Assessment Report (AR6) released in 2022.