We allow all citizens of the earth

to participate in building an ideal future

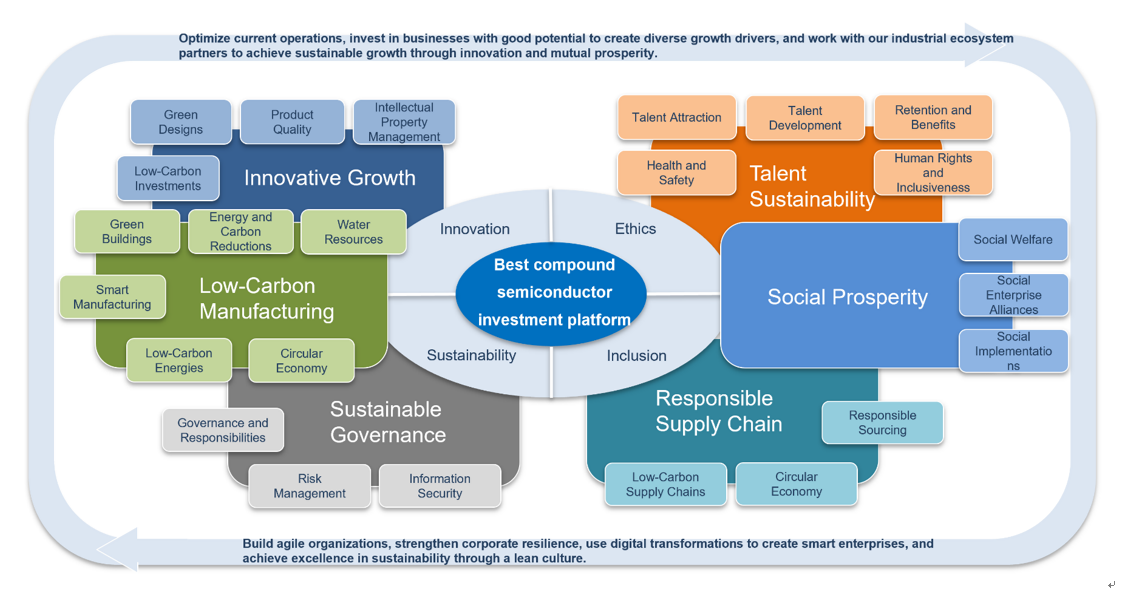

2022 is the Group’s first year of implementing sustainability and ESG actions. Our vision in business is to become the “best compound semiconductor investment platform” through our focus on four core concepts (innovation, integrity, inclusivity, and sustainability) and six major sustainable development aspects. Our parent company has established a dedicated sustainability department which continues to plan and promote Group sustainability transformations; coordinate short, medium, and long term plans; and gradually achieve the two main missions of our sustainability strategic blueprint. We hope our proactive management of climate risks, strengthening of sustainable development, and consideration of investor ESG expectations and needs can reduce environmental impacts while enhancing quality of life for all, enabling us to continue generating profits. We utilize the advantages and resources of our subsidiaries to expand our social influence and create a virtuous cycle of sustainability.

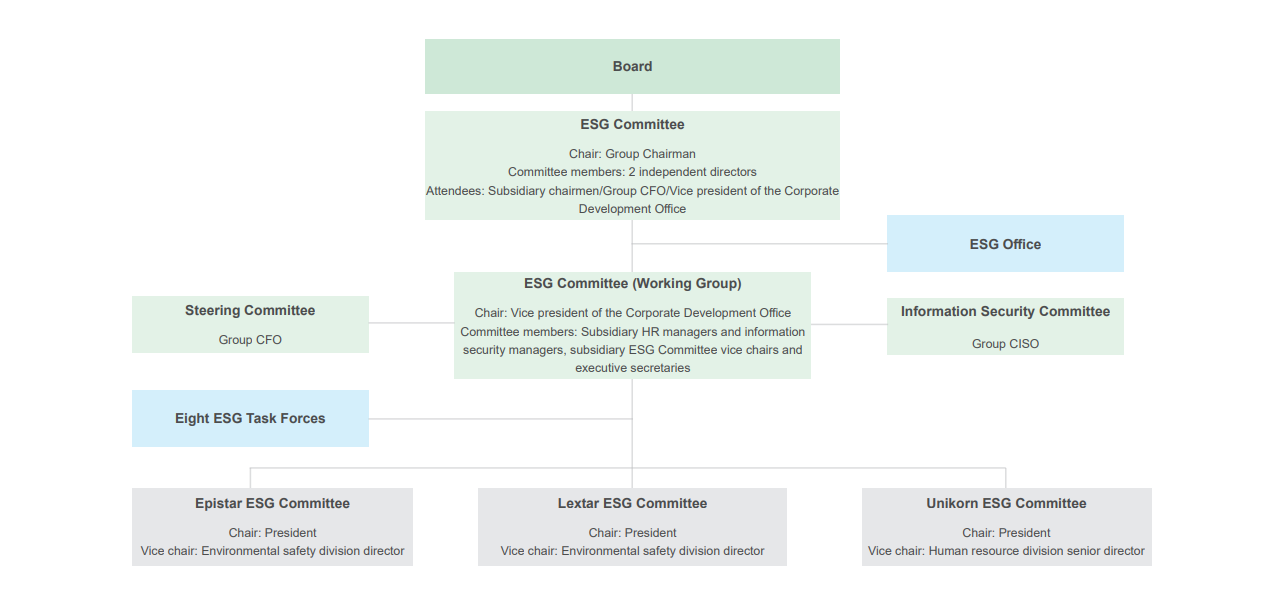

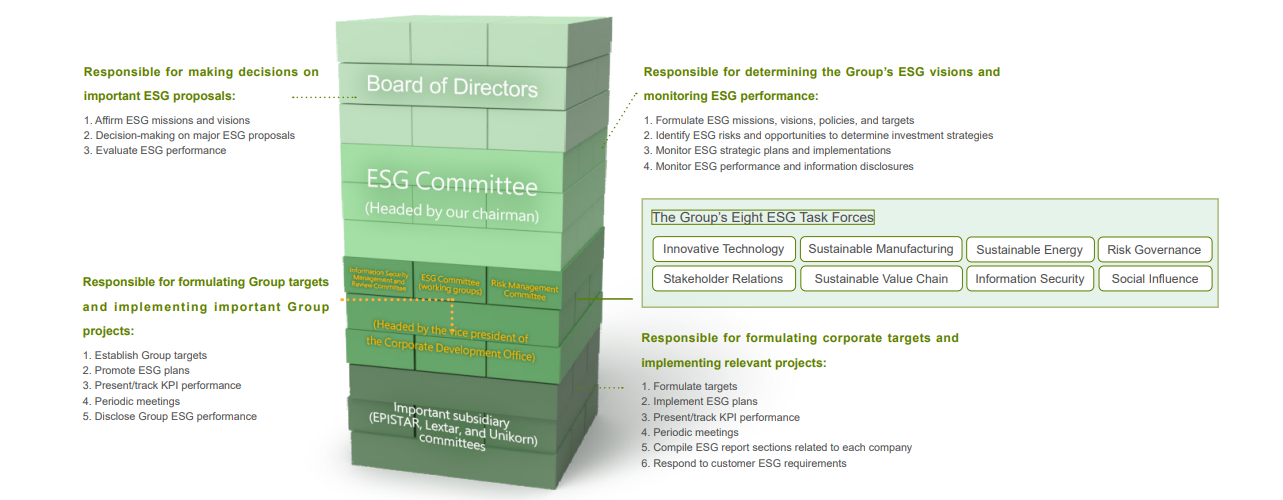

The Group’s Corporate Sustainability and Risk Management Committee operates on four levels, with the Board of Directors serving as the highest governance unit. We believe that ESG actions should be implemented not only through top-down directives, but also through encouragement of bottom-up proposals. We focus on Group targets, identify important projects, formulate related measurement indicators, and horizontally integrate subsidiary resources to jointly promote sustainable transformations. We accumulated a total of 485 targets from 2021 to 2023.

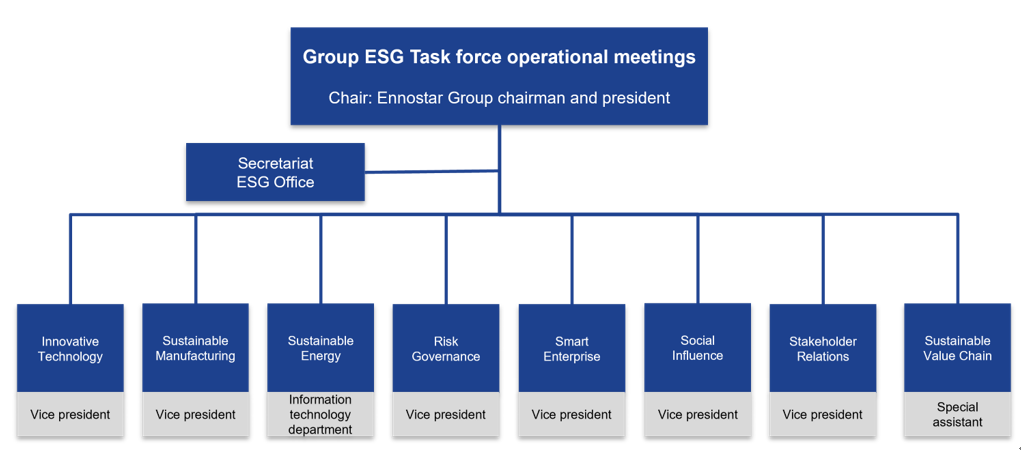

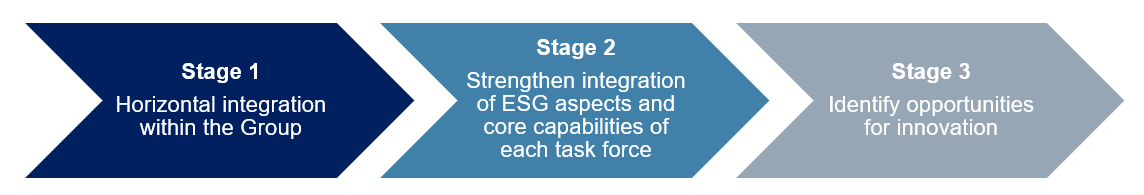

Group subsidiaries EPISTAR, Lextar, and Unikorn (and all their factories in Taiwan and China) have established respective ESG committees which are chaired by the presidents of each subsidiary, convene every month to review progress on all management guidelines, and facilitate vertical communications. We officially formed eight Group ESG task forces in the third quarter of 2022 to accelerate horizontal integration of sustainability issues within the Group and jointly achieve low-carbon manufacturing, innovation and growth, sustainability governance, talent sustainability, mutual prosperity, sustainable supply chains, and other goals while linking our sustainability strategies to international net zero trends to ensure full integration of ESG strategies in daily operations.

The Group strengthens sustainability through six major actions (targets, projects, our Sustainability Institute, ESG reports, our corporate website, and activities). We firstly focus on Group targets, identify important projects, formulate related measurement indicators, and horizontally integrate subsidiary resources. Internally, we have established a Sustainability Academy which offers various ESG courses taught by professional external speakers, hosts related activities, and compiles ESG columns for internal subsidiary publications so that our colleagues can be immersed in an atmosphere infused with ESG concepts. Externally, continued exposure through the media and regular publication of sustainability reports help us communicate with our stakeholders. In future, we will integrate ESG performance with our rewards systems to incorporate ESG concepts into routine tasks for all departments and make ESG a part of our corporate DNA.